LIC Bachat Plus

(A Non-Linked, Participating, Individual, Life Assurance Savings Plan)

LIC’s Bachat Plus is a Non-Linked, Participating, Individual, Life Assurance, Savings plan which offers a combination of protection and savings. This combination provides financial support for the family of the deceased policyholder any time before maturity and lump sum amount at the time of maturity for the surviving policyholders. This plan also takes care of liquidity needs through its loan facility. Proposer can choose to pay the premium either as Lumpsum (Single Premium) or for a Limited period of 5 years.

Death Benefit-

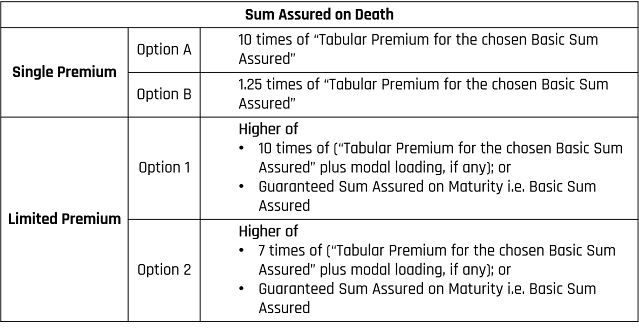

The proposer will have an option to choose “Sum Assured on Death” as per the two options available under each of Single Premium and Limited Premium payment.

The options should be chosen carefully depending on the individual’s specific needs as the premium and benefits under the plan shall vary as per the option chosen and the same shall not be altered later.

The availability of above Options shall be subject to eligibility conditions as mentioned in Para 2 below.

Note: In the above mentioned table

- “Tabular Premium” shall be the premium as applicable for Single Premium or Limited Premium for the chosen option and Basic Sum Assured based on the age of the Life Assured before allowing for any rebate or extra loadings. It does not include any taxes and Rider Premium, if any.

- “Basic Sum assured” is the guaranteed amount that is payable on maturity.

- “Modal Loadings” is an addition to the tabular premium where the premiums are paid more frequently than annually (i.e half-yearly or quarterly or monthly).

Death benefit payable in case of death of the Life Assured during the policy term provided the policy is in-force (i.e. all due premiums have been paid) shall be as under-

On death during first five policy years-

Before the date of commencement of risk-

Refund of premium(s) paid without interest shall be payable. The premium(s) referred above shall not include any taxes, extra amount chargeable under the policy due to underwriting decision and rider premium(s), if any.

On or after the date of commencement of risk-

“Sum Assured on Death” shall be payable.

On death after completion of five policy years but before the stipulated Date of Maturity-

“Sum Assured on Death” along with Loyalty Addition, if any, shall be payable.

“Sum Assured on Death” shall be as per the Option selected as detailed in the Table above.

The death benefit under Limited Premium payment shall not be less than 105% of all the premiums paid as on the date of death excluding taxes, extra premium and rider premium, if any.

Maturity Benefit-

On Life Assured surviving the stipulated Date of Maturity, provided the policy is in-force, “Sum Assured on Maturity” along with Loyalty Addition, if any, shall be payable, where“ Sum Assured on Maturity” is equal to Basic Sum Assured.

Loyalty Addition-

Provided the policy has completed five policy years and all due premiums have been paid, then depending upon the Corporation’s experience, the policies under this plan shall be eligible for Loyalty Addition at the time of exit in the form of Death during the policy term or Maturity, at such rate and on such terms as may be declared by the Corporation.

In addition, Loyalty Addition, if any, shall also be considered in Special Surrender Value calculation on surrender of policy during the policy term, under both single premium policy and limited premium payment policy, provided the policy has completed five policy years and all premiums due under the policy have been paid.

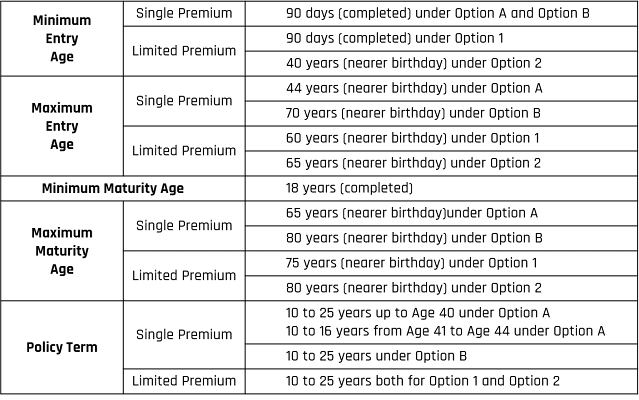

Eligibility Conditions and Other Restrictions-

Date of commencement of risk-

In case the age at entry of the Life assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement of the policy or from the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier.

For those aged 8 years or more at entry, risk will commence immediately from the date of acceptance of the risk i.e. from the Date of issuance of policy.

Date of vesting under the plan-

If the policy is issued on the life of a minor, the policy shall automatically vest in the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Corporation and the Life Assured.

Available Riders-

The following two optional riders are available under this plan by payment of additional premium at inception only.

- Accidental Death and Disability Benefit Rider

- New Term Assurance Rider

Payment of Premiums-

Premiums can be paid either in lumpsum or regularly during the Premium Paying Term at yearly, half-yearly, quarterly or monthly mode (through NACH only) or through salary deductions (SSS).

Grace Period-

Single Premium-

Not Applicable.

Limited Premium-

A grace period of 30 days shall be allowed for payment of yearly or half yearly or quarterly premiums and 15 days for monthly premiums from the date of First Unpaid Premium. During this period, the policy shall be considered in-force with the risk cover without any interruption as per the terms of the policy. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

The above grace period will also apply to rider premiums which are payable along with premium for Base Policy.

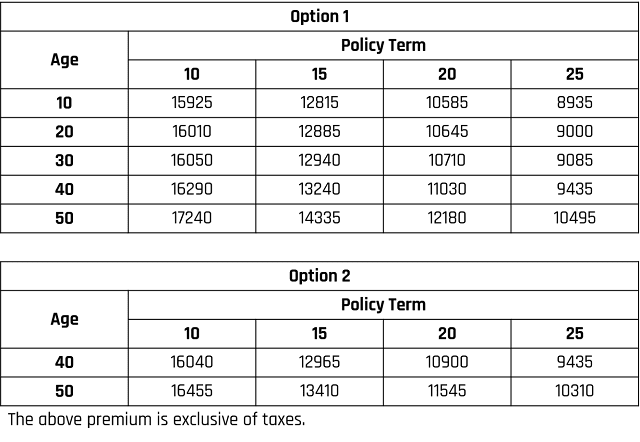

Sample Illustrative Premium-

Single Premium-

The sample illustrative single premiums for Basic Sum Assured of ₹1 lakh for Standard lives are as under-

Limited Premium-

The sample illustrative annual premiums for Basic Sum Assured of ₹1 lakh for Standard lives are as under

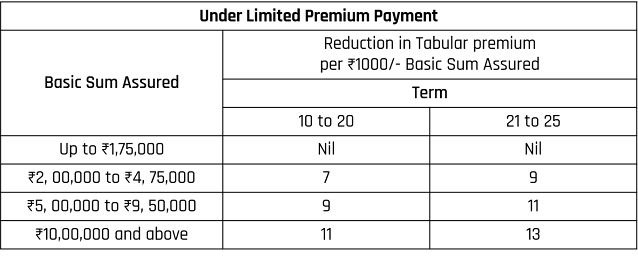

Modal Loading under Limited Premium-

Following Modal loading is applicable for Limited Premium Payment

High Basic Sum Assured Rebate-

Revival-

If the premium is not paid before the expiry of the days of grace, then the policy will lapse. A lapsed policy can be revived during the lifetime of the Life Assured, but within a period of 5 consecutive years from the date of First Unpaid Premium and before the date of maturity, as the case may be. The revival shall be effected, on payment of all the arrears of premium(s) together with interest (compounding half-yearly) at such rate as may be fixed by the Corporation from time to time and on satisfaction of Continued Insurability of the Life Assured on the basis of information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of a discontinued policy shall take effect only after the same is approved, accepted and revival receipt is issued by the Corporation.

The rate of interest applicable for revival under this plan for every 12 months period from 1st May to 30th April shall not exceed 10 year G-Sec Rate as p.a. compounding half-yearly as at the last trading day of previous financial year plus 300 basis points. For the 12 months’ period commencing from 1st May, 2020 to 30th April, 2021 the applicable interest rate shall be 9.5% p.a. compounding half-yearly.

Revival of rider(s), if opted for, will be considered along with revival of the Base Policy, and not in isolation.

Policy Loan-

Under Single Premium-

Loan can be availed under this plan at any time during the policy term after three months from completion of the policy (i.e. 3 months from the Date of issuance of policy) or after expiry of the free-look period, whichever is later subject to the terms and conditions as the Corporation may specify from time to time. The maximum loan that can be granted shall be 90% of the surrender value.

Under Limited Premium-

Loan shall be available under the policy provided, at least two full years premiums have been paid and subject to the terms and conditions as the Corporation may specify from time to time.

The maximum loan allowed under the policy, as a percentage of Surrender Value shall be as under

- For in-force policies – 90%

- For paid up policies – 80%

The interest rate to be charged for policy loan and as applicable for entire term of the loan shall be determined at periodic intervals.

The rate of loan interest applicable for full loan term, for the loan to be availed under this product for every 12 months period from 1st May to 30th April shall not exceed 10 year G-Sec Rate p.a. compounding half-yearly as at the last trading date of previous financial year plus 300 basis points. For loan sanctioned during 12 months period commencing from 1st May, 2020 to 30th April, 2021 the applicable interest rate shall be 9.5% p.a. compounding half-yearly for entire term of the loan.

Any loan outstanding along with interest shall be recovered from the claim proceeds at the time of exit.

No comments:

Post a Comment